Y Combinator W24 Demo Day: Which startups are investors watching out for?

Magic Hour dominates in monthly traffic, one-third of founders from Big Tech, IB or Consulting

Y-Combinator’s Demo Day for its Winter Batch of 2024 (YC W24) is just around the corner, happening on April 3rd and 4th.

YC’s demo day is an online, invite only event open to some 1500 investors where companies from the current batch are allowed to make a short pitch and grab additional funding. Companies like Stripe, Airbnb, Dropbox, and Doordash all had their starts here.

We, at Crustdata, have been tracking all of the YC companies since their inception. Today, we are analyzing all 161 companies that have gone through the W24 batch and are presenting some of the most interesting metrics. Since all of these companies are pretty early stage and lean, we focused on the 3-4 most important areas that make sense at an early stage. 1. Monthly Traffic 2. Focus areas 3. Founder’s Previous Companies & 4. Founder’s Educational Background.

Let’s dive in:

Monthly Web Traffic

Focus Areas

1. Magic Hour is building tools for content generation, editing & production, analytics to enable a new generation of AI-first creators.

Competitor Companies:

- Other companies offering AI-driven tools and platforms for content creation, such as Retrieve.

Technologies/Differentiator:

- Magic Hour differentiates itself through its focus on tools and technologies that integrate AI seamlessly into content creation workflows like automated content generation, intelligent editing assistance, and data-driven insights tailored for creators.

2. Artisan AI is building human-like digital workers, called Artisans, and the software operating system for startups across verticals.

Competitor Companies:

- Other companies offering AI-driven solutions for automating sales processes and digital workforce creation, such as Aomni.

Technologies/Differentiator:

- Artisan Technologies distinguishes itself through its primary focus on sales automation and its pioneering efforts in creating human-like digital workers and proprietary software.

3. sync. labs is building generative models to modify and synthesize humans in video through a synchronizer – a lip-syncing model to sync a video to audio in any language.

Competitor Companies:

- Other companies in the field of generative models and video synthesis, such as DeepMind and OpenAI.

Technologies/Differentiator:

- The company's innovative approach to overcoming language barriers in multimedia content through GenAI sets it apart in the industry.

4. Cleva Banking enables its clients to receive international payments (primarily USD) in their local currencies.

Competitor Companies:

- Other financial institutions and fintech companies offering international banking solutions and currency conversion services.

Technologies/Differentiator:

- Cleva distinguishes itself through its focus on providing services like USD banking and protection against inflation to individuals and businesses in developing countries.

5. AgentHub is building a platform for LLM-powered automations.

Competitor Companies:

- Other platforms and companies offering AI-driven solutions for business process automation, such as UiPath and Automation Anywhere.

Technologies/Differentiator:

- AgentHub's primary differentiator lies in its utilization of Language Learning Models (LLMs) to power its automation solutions.

6. Million.js is a developer tool for optimizing web performance of React and making it faster.

Competitor Companies:

- Other companies offering developer tooling and resources for web performance optimization, such as Google's Lighthouse, WebPageTest, and Pingdom.

Technologies/Differentiator:

- Million.js differentiates itself through its focus on providing comprehensive developer tooling tailored for algorithms & analytics to improve website speed, responsiveness, and overall user experience.

7. Quivr offers an open-source framework called RAG, designed to facilitate the development and deployment of applications and solutions.

Competitor Companies:

- Other companies providing open-source frameworks and tools for software development, such as TensorFlow, PyTorch, and Apache Spark.

Technologies/Differentiator:

- Quivr's primary differentiator is its open-source RAG framework, which enables developers to create and deploy applications efficiently, through collaboration and optimization.

8. HostAI helps vacation rental managers in managing their teams efficiently, including task assignment, scheduling, and performance tracking.

Competitor Companies:

- Other companies offering AI-driven solutions for vacation rental management, such as Guesty, Lodgify, and Evolve Vacation Rental.

Technologies/Differentiator:

- HostAI's primary differentiator lies in its suite of tools and solutions tailored integrated with AI-driven automation to simplify management tasks.

9. Reducto AI converts complex documents of Large Language Models (LLMs) into structured data for any workflow.

Competitor Companies:

- Other AI-driven platforms and tools focused on document processing and data extraction, such as Abbyy and Rossum.

Technologies/Differentiator:

- Reducto AI's primary differentiator lies in its expertise in employing advanced algorithms and machine learning techniques to accurately extract and organize information from large volumes of unstructured data.

10. Circleback is a platform for making AI-powered notes, action items and automations. It works as an extension with google meet, slack, microsoft teams etc.

Competitor Companies:

- Other companies offering AI-driven solutions for meeting management and note-taking, such as Otter.ai and Microsoft OneNote.

Technologies/Differentiator:

- Circleback's primary differentiator lies in its AI-driven approach to generating trustworthy and comprehensive documentation of their meetings.

Founder’s Previous Employers

Founder-market fit has always been a popular framework for investments at the early stage. A strong way to assess founder-market fit is through previous work experience. Most investors, including YC, give a ton of weight to a founding team that has previously built in the space that they are going after (e.g. ex-Stripe folks that are building a payments company).

We track the previous companies and titles of the founders in the Crustdata database and wanted to see the previous companies of the founders in the current YC batch.

Amazingly, a staggering 15% of the YC W24 founders have worked at a MAANG (Meta, Apple, Amazon, Netflix & Google) company. About 8% have worked in other bigtech companies (Microsoft, Tesla, Uber, Stripe & Palantir).

Around 4% have previously worked in a Fortune 500 company (IBM, Salesforce & Accenture) and another 4% have previously been in Investment Banking/Management Consulting (Goldman Sachs, Mckinsey & Company and BCG).

Clearly, YC loves founders that have cut their teeth at brand names.

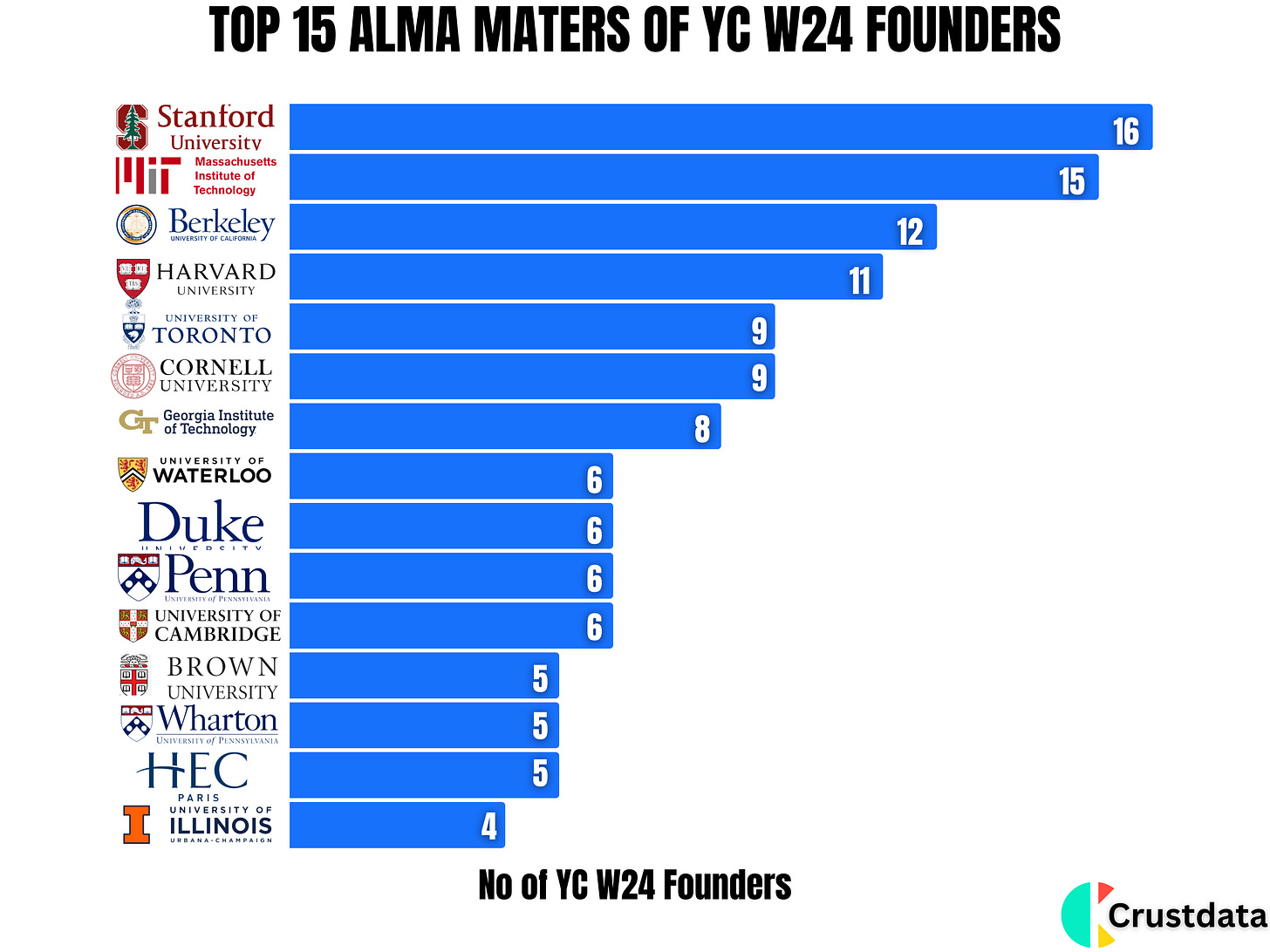

Founder’s Educational Background

Educational background serves as another benchmark to assess the investability of a founding team. Mark Zuckerberg founded Facebook with his friends from the dorms of Harvard, Robinhood was founded at Stanford and even the goated Paypal Mafia met through the student networks at Stanford and University of Illinois.

As for the YC W24 batch, 8% attended an Ivy League school. Around 7% went to either Stanford, MIT or Duke University. 2% graduated from University of California Berkeley.

YC most certainly takes educational pedigree into account when assessing the founders to bring into its program. Paul Graham, YC’s founder, recently said on X,

“Given the uncertainty around US college admissions, founders who are able to get to top schools in the US will relatively do better with their startups.”

As for the make up of the YC W24 batch, as expected AI startups took the largest chunk of investment (about 70%) and Devtools and Enterprise SaaS finished a close 2nd and 3rd respectively.

Stay tuned for more analysis on the YC W24 companies and founders in subsequent newsletters. If you are interested in obtaining the data for yourself, please check us out at crustdata.com or write to us at info@crustdata.com .

About the data

The data seen above is from Crustdata - the most accurate AI powered data-driven market intelligence platform for private growth stage investors and sales leaders. It indexes billions of public data points on companies every week to provide an edge over the private market.

Love this piece!!